Back to ProjectsFinance

Antifragile Investment Portfolio

Design an investment portfolio that not only withstands market volatility but benefits from it.

The Challenge

Design an investment portfolio that not only withstands market volatility but benefits from it.

Approach & Methodology

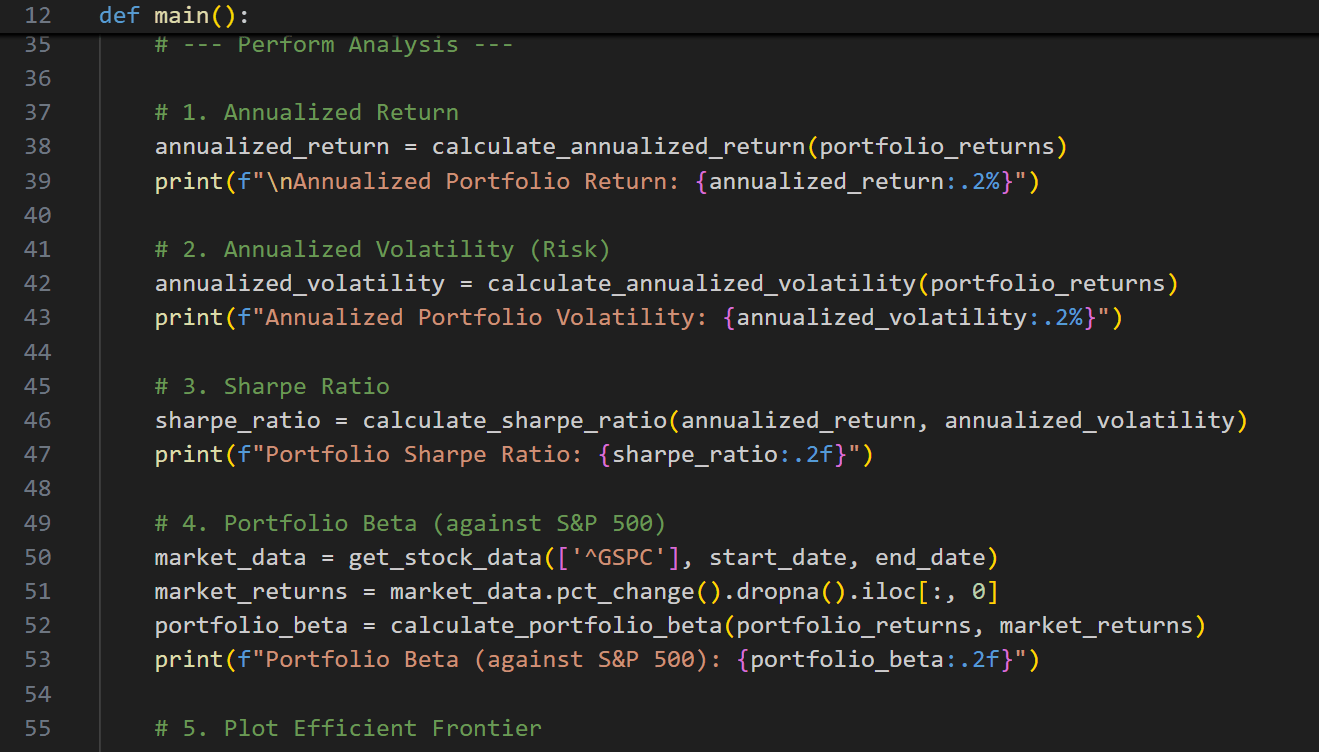

Applied principles from Nassim Taleb's 'Antifragile'. Used Monte Carlo simulations to test portfolio performance under various stress scenarios. Optimized asset allocation using modern portfolio theory.

Solution & Results

Constructed a diversified portfolio with a mix of traditional assets and options strategies designed to have convex responses to market shocks.

Business Impact

The portfolio is designed to provide stable returns in calm markets and significant upside during black swan events.

Role

Portfolio Manager

Category

FinanceTools & Technologies

PythonpandasNumPyExcel